The New York State Tax Department is urging individuals and families to check out tax credits that could amount to thousands of dollars added to a refund or taken off a tax bill.

The Earned Income Tax credit is available to anyone who worked and made less than $68,675.00 in 2025. The credit goes up with family size. There’s an earned-income credit at both the state and federal level, which can multiply the credit. More information on eligibility is on the Tax Department’s Earned Income Credit (New York State) webpage.

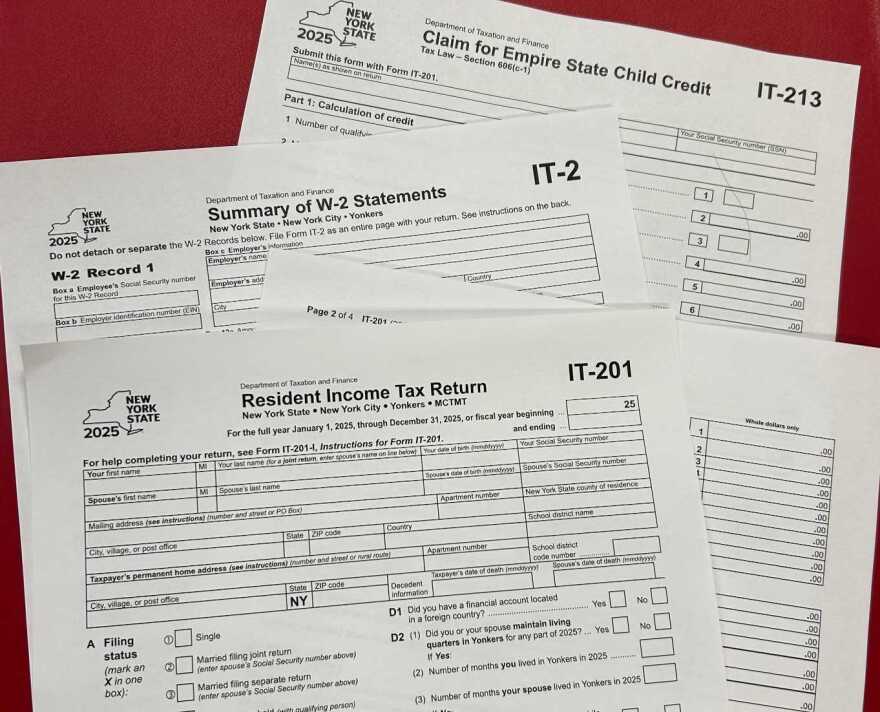

Parents can qualify for an expanded Empire State Child Credit. The credit can reduce your tax bill or increase your refund by $1000.00 for each child under age 4. The credit was increased for 2025 from $330.00-per-child. It remains $330.00 for children age 4 to 16. Taxpayers were required to be state residents for the entire year, in order to qualify for it. The credit applies if you have at least one qualifying child less than 17-years-old as of December 31, 2025. More information on this credit can be found at the Empire State child credit page.

The Tax Department adds both credits can be received even if you don't owe taxes, but recipients must file a tax return. Most taxpayers who qualify for the Earned Income Tax Credit will also be eligible for Free File.

More information is at tax.ny.gov.