Tax delinquent homes draw a lot of attention … but corporate properties currently owe Onondaga County more than $45 million dollars in back taxes, according to officials. The county has a new strategy to go after the money – or the property.

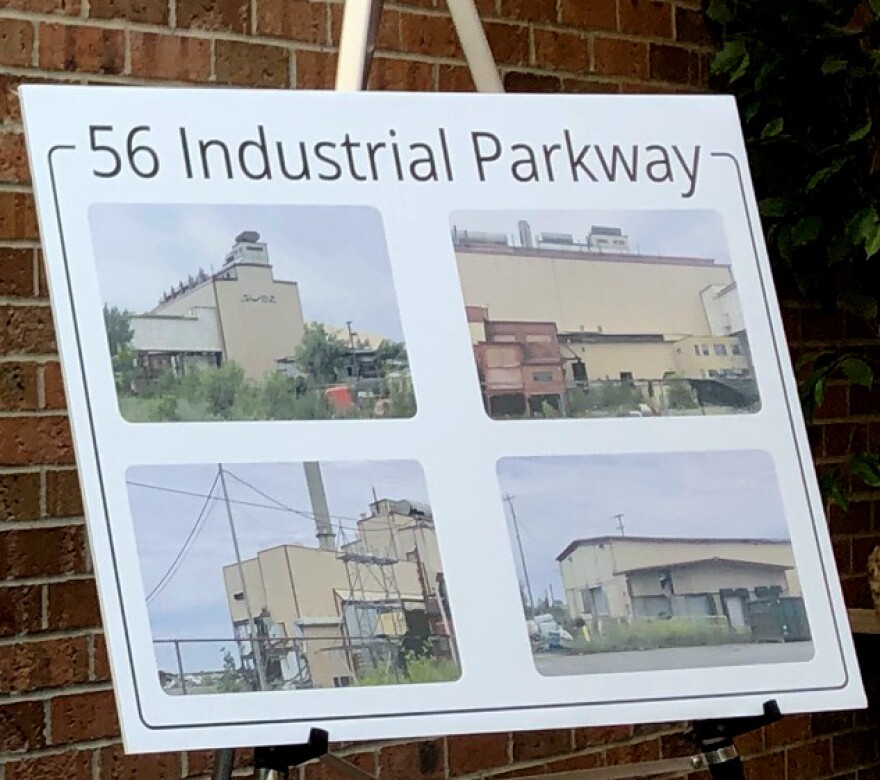

The county had an interesting problem on its hands…a property in Solvay that owes more than a million dollars in back taxes. And County Executive Ryan McMahon says it looked like owners were dismantling large buildings on the site to sell for scrap. That further devalues a property the county might end up seizing for the back taxes. McMahon says the former Syracuse Energy Corp property is the first target after years ignoring tax bills.

“But certainly we believe this property is valuable. We believe it's got the potential for a great economic development end use. But we can no longer sit there and allow this property to be scrapped of its assets while this company does not pay taxes.”

Some are auctioned off … but the county wants to guide redevelopment of certain sites. That’s where the new County Accountability and Reinvestment Corporation comes in. It would hold title – if seized -- while the Industrial Development Agency markets and works on details with some new owner.

“If we are able to get back $1 million that we've paid out to municipalities for property taxes, that is money that goes into our reserve account. That's money gets invested in infrastructure, gets invested into people. In addition to that, this property has value and it has infrastructure. It has public power, its by rail. So, we think that this site has real value to be a high performing asset for the community, or else we wouldn’t be here talking about taking this step.”

He adds the County Legislature will be asked next month to transfer title of the property, 56 Industrial Parkway in Solvay, to the county entity. The 11-acre property sits between Milton Ave. in Solvay and train tracks, just East of Bridge Street.

McMahon also addressed the most prominent tax-delinquent property, Shoppingtown.

“By end of year we think there will be definitive action. When you get to the point where you’ve lost tax certiorari (proceedings), lost court cases at appeals level, you’re exhausting your options. They owe the taxpayers of this community a lot of money; there’s no reason they shouldn’t be paying.”

McMahon repeats the county has offered to negotiate numerous times … but found little interest in Moonbeam Capital to develop the property or in any payment plan. He says the county will remain aggressive in going after the revenue owed county and its taxpayers.